Isabel Prado

About Me

My name is Isabel Prado. I was born and raised in Guatemala. I am currently pursuing a Bachelor of Science degree in Business and Economics at Lehigh University in Bethlehem, PA, I am graduating on May 2023. I am double majoring in Finance and Business Analytics and have also chosen to pursue a double minor in Engineering and Business Information Systems.

Through my coursework, I have gained knowledge in a variety of business-related areas, including Investments, Security Analysis & Portfolio, Financial Accounting, and Predictive Analytics in Business. These courses have provided me with a solid understanding of financial concepts, such as investment strategies, financial statement analysis, and data analytics.

In addition to my major, I am also interested in the technical aspects of business, which is why I chose to pursue a double minor in Engineering and Business Information Systems. These minors have allowed me to gain knowledge in areas such as systems analysis and data management, which I believe will be valuable in my future career.

Portfolio

The report has a step by step process of the project. The project comprised several essential steps, starting with downloading the last 10k files for the 500 firms published at the end of 2022. I then went on to reduce hardware space and cleaned the data to make it more manageable. Once the data was prepared, I determined the filling dates of the 10k files to help me identify the information I needed to work with. The next step involved introducing a data set called “crsp,” which I used to calculate the cumulative returns of the firms. This calculation provided valuable insights into how the firms were performing and helped identify the highest-performing firms in the group. To further enhance the analysis, I introduced sentiment dictionaries to the data and calculated sentiment scores on three different topics. This additional analysis helped provide a better understanding of how the public perceived the firms and how that perception influenced their performance. Finally, I merged the data into a CSV to create an output of the results, making it easy to analyze and understand the information.

Midterm Analysis

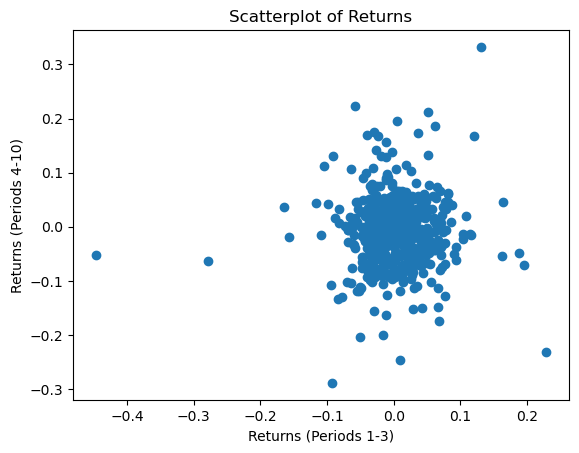

Some of the key findings from the report include that the mean return for the period from 0 to 2 was 0.003971, indicating a small profit on average. However, the mean return for the period from 3 to 10 was -0.007203, indicating a slight loss on average. The standard deviation for the period from 0 to 2 was 0.051677, indicating a relatively high degree of variability in the returns over this period. The standard deviation for the period from 3 to 10 was 0.066073, which is slightly higher than the standard deviation for the earlier period. The minimum and maximum cumulative returns for the period from 0 to 2 were -0.447499 and 0.229167, respectively. For the period from 3 to 10, the minimum and maximum cumulative returns were -0.288483 and 0.332299, respectively. The 25th, 50th (median), and 75th percentiles are also provided in the table, which can give further insights into the distribution of returns for each period. Overall, these results suggest that investing in S&P500 firms involves significant risk, as the returns can be highly variable and investors may experience both gains and losses over different time periods.

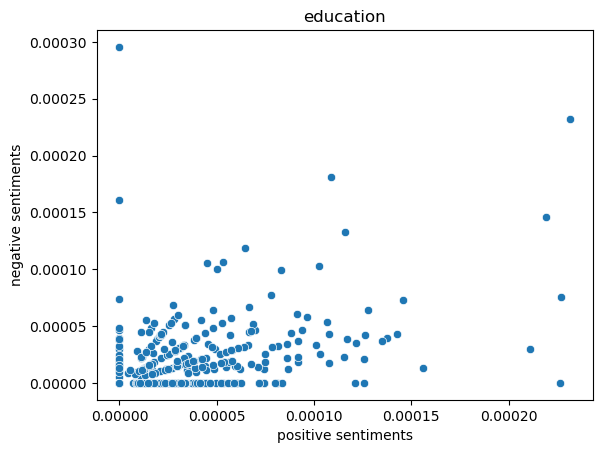

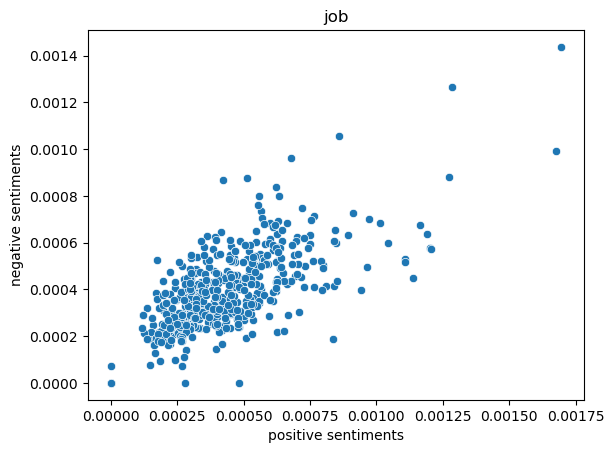

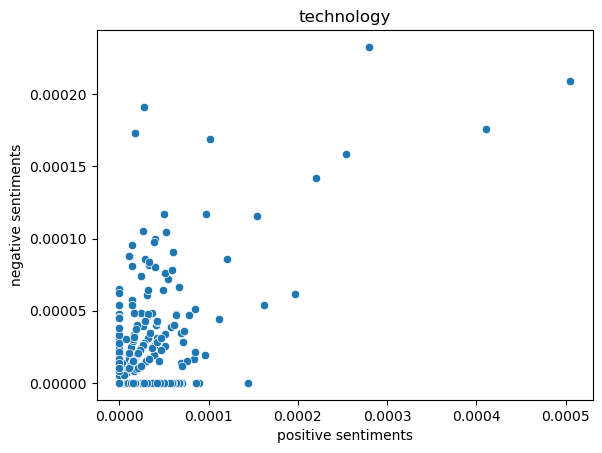

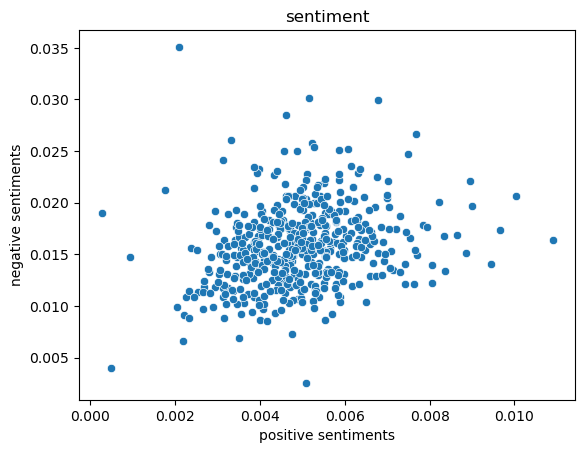

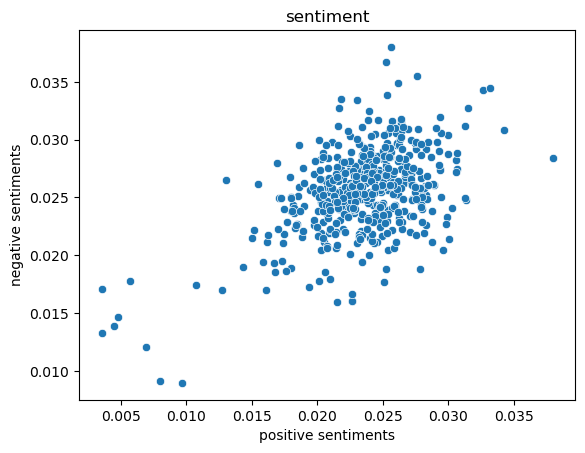

The sentiment analysis involved several steps. Firstly, two sentiment dictionaries, namely “LM_MasterDictionary_1993-2021.csv” and “ML_negative_unigram.txt”, were downloaded and divided into positive and negative sentiments. Then three topics were chosen because they are both popular and neutral topics (Education, Job, and Technology.)

The LM_MasterDictionary was used for the LM positive and negative calculation, this data has not been updated and this may impact the analysis negatively becuause is generalizing words to measure the sentiment.

For the team project, I am working with Margaux Brenan and natanzrosen. Our team “We margauxing to rock this” will be developing our team project website.

Internship experience:

I have professional experience in the finance industry through my internships at various companies. At Cementos Progreso, I interned from June to July 2022 and created financial models to help identify potential acquisition projects in Central America for the largest cement producer in Guatemala.

My work at Diaz- Bazan Asset Management involved an internship from August 2021 in Boston. During this time, I reviewed economic fundamentals and credit ratings to select investment ideas in bonds. I also analyzed the impact of changes in US interest rates on the pricing of emerging market sovereign debt and prepared reports on my economic analysis and research results to share with the head trader.

I interned at Wood & Company Investment Bank in Czech Republic from May to July 2021, where I researched companies in the airline industry to help price merger deals in Central and Eastern Europe. I also analyzed real estate projects for the leading investment company in Greece.

These experiences have given me a broad range of financial knowledge and skills, including financial modeling, economic analysis, and investment research. I have also gained experience working with real-world clients and making recommendations based on my analysis

Career Objectives

As someone with a strong technical background in Microsoft Excel, AutoCAD, R Studio, and SQL. Combined with my fluency in English and Spanish. I believe that my technical skills and language abilities will allow me to excel in a finance role, whether it be in investment banking or risk management. I am excited to apply my analytical and problem-solving skills to real-world financial challenges and leverage my language proficiency to communicate effectively with a diverse range of clients and colleagues. Ultimately, I am passionate about utilizing my skill set to drive positive financial outcomes and contribute to the growth and success of an organization.

Hobbies

Growing up in Guatemala helping my community has always been very important for me. I’ve worked with different non-profit organizations.

- With America Reads/Counts program, I mentored and tutored middle school students to improve their reading and math skills. I have also volunteered at the Public Cancer Hospital UNICAR, collaborating in a program focused on emotional well-being to support children with cancer and low-income families. I volunteered and taught at Casa del Alfarero, a program focused on health and nutrition development for malnourished children of single mothers. During my time there, I taught weekly English classes to low-income children. Overall, I find joy in volunteering and helping others through education, health, and emotional support programs.

I also enjoy playing tennis and the piano in my free time.

Page template forked from evanca